As Canada stands on the precipice of a financial revolution driven by government initiatives like the Consumer-Driven Banking Act, the nation's financial institutions face a critical inflection point. The push towards open banking promises a new era of consumer empowerment and financial innovation,

The recent public listing of BitGo has been widely interpreted not merely as a corporate success but as a powerful validation of the entire digital asset infrastructure by the world’s most demanding financial markets. This IPO represents a landmark moment, signaling that the institutional

For years, Chief Financial Officers across Central and Eastern Europe have navigated a complex and fragmented financial landscape, where managing multiple entities, bank accounts, and currencies often felt like a high-wire act performed without a safety net. The year 2025, however, marked a

A monumental surge in borrowing across Saudi Arabia has propelled the kingdom's leading financial institutions to unprecedented heights, with two of the largest banks reporting record-breaking profits for the 2025 fiscal year. The recently released financial results for Saudi National Bank (SNB)

The Swiss financial landscape is undergoing a profound transformation, moving beyond traditional wealth management to become a global epicenter for tangible, market-ready innovation. As the industry grapples with integrating disruptive technologies like distributed ledgers and digital assets into

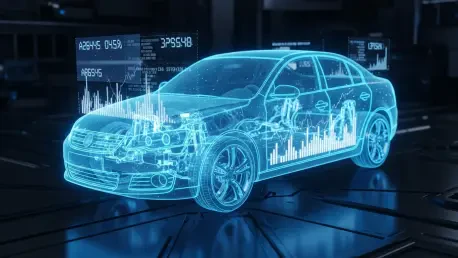

The line separating your car dealer from your financial institution has just been decisively erased, marking a watershed moment in American commerce as two of the nation's most iconic automakers prepare to take your deposits. In a move that signals a seismic shift in the financial landscape, the