Pouring billions into digital transformation has become an annual ritual for the world's largest financial institutions, yet the chasm between their futuristic ambitions and their legacy-burdened reality continues to expand at an alarming rate. For every sleek mobile application and AI-powered

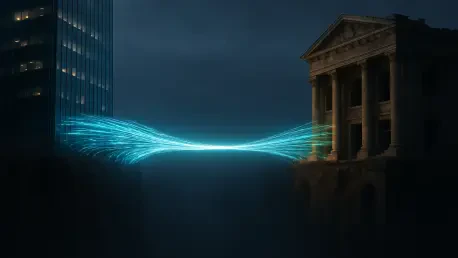

The intricate web of digital payments that underpins the modern economy, processing trillions of dollars daily, relies on an infrastructure that many of its most innovative players can only access indirectly. As financial technology companies continue to redefine how money moves, the Federal

The American financial sector is currently navigating a period of unprecedented change, with the strategic decisions institutions make today setting the course for market leadership for the next decade. Following a year of significant technological and regulatory shifts in 2025, the industry now

With a sharp eye for market dynamics and a deep understanding of the financial sector's regulatory currents, Priya Jaiswal has become a go-to authority on the forces shaping the U.S. banking landscape. She joins us today to unpack the recent surge in M&A activity, offering a look inside the

Agentic artificial intelligence has already demonstrated its formidable power by successfully automating and optimizing a vast array of internal workflows within financial technology companies, marking a significant milestone in operational efficiency. The industry is now standing on the precipice

The worlds of financial technology and purpose-driven investment are rapidly converging, and a recent acquisition in Europe offers a compelling glimpse into their shared future. The Lisbon-based fintech Goparity, a specialist in lending-based impact projects, has acquired Bolsa Social, Spain’s