Thailand is on the brink of a significant policy shift with the potential legalization of online gambling. This move, driven by economic incentives, aims to regulate and tax an already thriving underground industry. However, the prospect of legalizing online gambling brings with it substantial

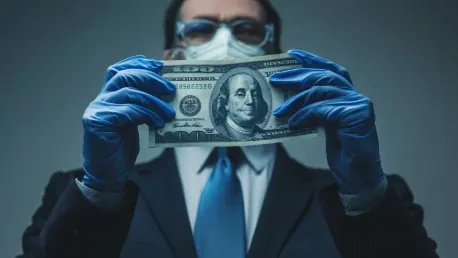

The Solicitors Regulation Authority (SRA) has recently issued crucial guidance urging law firms to take robust measures to protect themselves from sham litigation, a deceptive scheme used by criminals to bypass anti-money laundering (AML) regulations. Sham litigation involves fabricating legal

The House of Representatives Committee has launched an extensive investigation into Sterling Bank following allegations of money laundering, unauthorized deductions, and other financial irregularities. The probe, which also implicates the Central Bank of Nigeria (CBN) and Shell Petroleum, was

Sterling Bank Limited has found itself embroiled in a controversy as serious allegations of money laundering and fraud involving $28.3 million have come to light. These allegations were brought forward by Miden Systems Ltd and its director, Dr. Brendan Innocent Usoro. The case began gaining

The ongoing investigation involving K.T. Rama Rao, commonly known as KTR, who serves as the working president of the Bharat Rashtra Samithi (BRS) and is a former Municipal Administration Minister, has captured significant public and media attention. The case revolves around allegations of financial

The increasing complexity and stringent nature of regulatory demands have made compliance a considerable challenge for businesses, especially those in highly regulated industries. The need to adhere to legal standards, manage detailed reporting, and mitigate risks often requires substantial