Qonto, a leading business finance solutions provider, is embarking on an ambitious expansion into Austria, Belgium, the Netherlands, and Portugal. The goal is clear: to become the go-to financial service provider for European SMEs and freelancers by 2026. As businesses increasingly seek digital solutions, Qonto’s strategy could potentially revolutionize the way SMEs manage their finances across Europe.

The Driving Force Behind Qonto’s Expansion

Identifying Unmet Financial Needs

Qonto identifies a significant gap in the financial services available to SMEs and freelancers. Despite constituting 99% of all businesses in Europe and generating around 100 million jobs, small and medium-sized enterprises often face hurdles in accessing efficient financial services. Traditional banks have not fully adapted to the unique needs of these businesses, leaving a void that Qonto aims to fill. Understanding these challenges, Qonto’s strategy focuses on providing a more inclusive and efficient financial solution tailored to SMEs.

Entrepreneurs and small businesses frequently encounter obstacles such as high banking fees, cumbersome account management processes, and a lack of integrated financial tools. SMEs need solutions that streamline their financial operations, allowing them more time to focus on growth and innovation. By offering an online business account supplemented with invoicing, bookkeeping, and spend management tools, Qonto simplifies these day-to-day banking operations. This comprehensive approach not only meets the immediate financial needs of SMEs but also supports their long-term scalability and efficiency.

Tailored Financial Tools

Since its founding, Qonto has been on a mission to simplify day-to-day banking for businesses. Their offering includes a comprehensive suite of tools such as invoicing, bookkeeping, and spend management, all integrated into an intuitive online business account. By focusing on these tailored financial tools, Qonto has positioned itself as an essential partner for SMEs looking to enhance operational efficiency and scalability. The platform’s user-friendly design ensures that businesses, regardless of size or technical fluency, can easily manage their finances.

Integration of these tools provides a seamless experience that contrasts sharply with the often fragmented services offered by traditional banks. Whether it’s automating routine financial tasks or providing real-time financial insights, Qonto’s platform addresses key pain points faced by SMEs. For instance, automated invoicing can significantly reduce the time spent on manual entries, while real-time tracking of expenses allows for more accurate budgeting and financial planning. These features are designed to help businesses not only survive but thrive in an increasingly digital economy.

Market Research: The Backbone of the Strategy

Deep Dive Into Local Markets

To ensure their services meet the specific needs of their new markets, Qonto invested extensively in market research. This included studies, surveys, reports, and even phone interviews to gather data from local SMEs and freelancers. This approach aims to ensure that their financial products are not just relevant but also genuinely beneficial for the new customer base. By scrutinizing local market dynamics, Qonto is better equipped to tailor their offerings to address unique regional challenges and opportunities.

Market research forms the backbone of Qonto’s strategic decisions, enabling the company to align its services with the specific demands of different European markets. The insights gleaned from this exhaustive research provide a roadmap for customization, ensuring that Qonto’s services are both competitive and effective. For instance, understanding regulatory variations and cultural nuances allows Qonto to deliver solutions that are not only compliant but resonate well with local businesses. This localized approach positions Qonto as a trusted financial partner, capable of contributing meaningfully to the success of SMEs across Europe.

Collaborations With Local Stakeholders

Qonto’s strategy also involves active collaborations with local chambers of commerce and tech and fintech associations. These partnerships are designed to gain local insights and further tailor their services to meet regional business requirements. This granular level of understanding positions Qonto to offer finely tuned solutions that can significantly reduce administrative burdens for SMEs. By engaging with local stakeholders, Qonto harnesses valuable on-the-ground knowledge, which enhances their ability to deliver targeted financial services.

These collaborations are crucial for the company’s long-term success, as they enable Qonto to stay attuned to evolving market needs and preferences. For instance, working with local chambers of commerce allows Qonto to understand the specific regulatory and economic environments of each market, facilitating smoother operational transitions. Additionally, partnerships with tech and fintech associations help Qonto stay at the cutting edge of technological advancements, ensuring that their platform remains innovative and relevant. Through these collaborative efforts, Qonto not only enhances its service offerings but also fosters a supportive ecosystem that benefits the broader business community.

Partnering for Enhanced Services

Streamlining Cross-Border Transactions

One of the standout elements of Qonto’s strategy is its partnership with Wise, a company renowned for facilitating international payments. Many SMEs struggle with the complexity, slow processing times, and high costs associated with cross-border transactions. Through this collaboration, Qonto aims to simplify and expedite these processes, adding immense value for businesses involved in international trade. By leveraging Wise’s expertise, Qonto can offer faster, cheaper, and more transparent international payment solutions.

The partnership with Wise directly addresses one of the most pressing issues faced by SMEs engaged in global trade—inefficient cross-border transactions. By integrating Wise’s streamlined payment solutions into its platform, Qonto provides its users with a more cohesive and efficient banking experience. This not only enhances operational efficiency but also reduces the financial burden associated with international transactions. Consequently, SMEs can reallocate these savings towards growth initiatives, further solidifying Qonto’s role as a vital financial partner.

Broader Impact of Collaborations

Partnerships like the one with Wise reflect a broader trend towards creating collaborative ecosystems in fintech. By aligning with other industry leaders, Qonto is able to enhance its service offerings and address specific pain points more effectively. These collaborations are crucial for delivering a holistic financial solution that meets the varied needs of SMEs across Europe. This ecosystem approach allows Qonto to rapidly adapt to market changes and continuously improve its value proposition.

Through strategic collaborations, Qonto gains access to a wealth of resources and expertise, enabling the company to innovate and expand more rapidly. These partnerships facilitate the integration of specialized services that complement Qonto’s core offerings, creating a more comprehensive solution for SMEs. Whether through enhanced payment processing, improved financial analytics, or streamlined compliance, these collaborative efforts ensure that Qonto remains at the forefront of fintech innovation. The cumulative impact of these initiatives reinforces Qonto’s commitment to revolutionizing SME banking across Europe.

Capitalizing on Digital Transformation

Shift to Digital Platforms

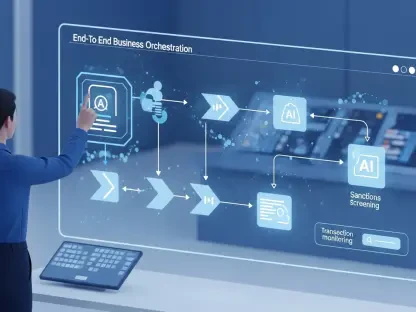

A notable trend among European SMEs is the shift towards digital platforms for managing finances. Qonto’s digital-first approach fits perfectly into this evolving landscape. Their platform not only simplifies financial management but also offers the agility that traditional banks often lack. This shift is particularly appealing for SMEs looking for efficient, streamlined solutions. By embracing digital transformation, Qonto provides a modern banking experience that meets the dynamic needs of today’s business environment.

Digital platforms offer numerous advantages, including real-time access to financial data, automated processes, and seamless integrations with other business tools. These features help SMEs operate more efficiently, reducing the time and effort spent on financial management. Qonto’s platform harnesses these advantages, enabling businesses to make more informed financial decisions. This level of responsiveness and efficiency is crucial for SMEs in a rapidly changing market landscape, where agility can be a significant competitive advantage.

Advantages of a Digital-First Approach

Qonto’s digital infrastructure allows for rapid scalability and responsiveness to market changes. This advantage is crucial for SMEs that need to adapt quickly to evolving business conditions. By leveraging digital solutions, Qonto can provide real-time financial insights, which are invaluable for business decision-making. The platform’s ability to scale efficiently ensures that Qonto can accommodate a growing user base without compromising on service quality.

A digital-first approach also enables Qonto to offer a more personalized and user-centric banking experience. Advanced data analytics and artificial intelligence can be used to customize financial services to better meet the specific needs of individual businesses. This level of personalization enhances customer satisfaction and loyalty, further driving Qonto’s growth and market penetration. Additionally, digital solutions offer greater operational flexibility, enabling Qonto to continuously innovate and improve their service offerings. This commitment to digital excellence positions Qonto as a leader in the fintech space, well-equipped to drive the future of SME banking in Europe.

The Road Ahead: Insights and Lessons from Previous Expansions

Learning From Past Expansions

Having already launched successfully in France, Germany, Italy, and Spain, Qonto has a wealth of experience to draw upon. These previous expansions have provided critical insights that are instrumental as they venture into new markets. By learning from their past experiences, Qonto is better prepared to navigate the challenges and opportunities that lie ahead. Every market entry has contributed to a deeper understanding of different regulatory landscapes, customer behaviors, and competitive dynamics.

Previous successes and challenges have shaped Qonto’s strategic approach, allowing the company to refine its products and services continually. For instance, feedback from users in established markets has been invaluable in identifying areas for improvement and innovation. This iterative process ensures that Qonto’s platform remains responsive to customer needs and industry trends. Moreover, lessons learned from past expansions have also highlighted the importance of agility and adaptability, critical factors for thriving in diverse European markets. These insights are the foundation upon which Qonto builds its future expansion strategies.

Importance of Adaptation

One key lesson from these past expansions is the importance of adaptability. Each market has unique characteristics and requirements, and Qonto’s success will depend on its ability to adapt its offerings accordingly. This flexibility ensures that Qonto remains relevant and effective regardless of regional nuances. By customizing their services to meet local needs, Qonto can provide more meaningful financial solutions that resonate with SMEs and freelancers in each market.

Adaptation extends beyond merely customizing products; it involves understanding and integrating into the local business culture. This holistic approach ensures that Qonto’s services are not only functional but also culturally aligned with their target audiences. For example, adapting user interfaces to local languages and incorporating region-specific features can significantly enhance user adoption and satisfaction. By fostering a deep connection with each market, Qonto builds trust and loyalty among its users, laying a robust foundation for sustained growth. This commitment to adaptability underscores Qonto’s vision of becoming the premier financial service provider for SMEs across Europe.

Conclusion

Qonto, a prominent provider of business finance solutions, is making a bold push to expand into Austria, Belgium, the Netherlands, and Portugal. This strategic leap aims to position Qonto as the premier financial service provider for small to medium-sized enterprises (SMEs) and freelancers throughout Europe by 2026. As digital solutions become increasingly vital for business operations, Qonto’s innovative approach could significantly transform how SMEs handle their financial management across the continent.

By providing a comprehensive suite of digital financial services, including expense tracking, invoicing, and financial reporting, Qonto is addressing the unique needs of European SMEs and freelancers. Their user-friendly platform is designed to simplify financial tasks, offering greater efficiency and control over one’s business finances.

This expansion comes at a time when more businesses are seeking reliable, digital financial tools to stay competitive and agile. If successful, Qonto’s initiative could serve as a model for other financial service providers, leading to widespread improvements in financial management practices for businesses across Europe.