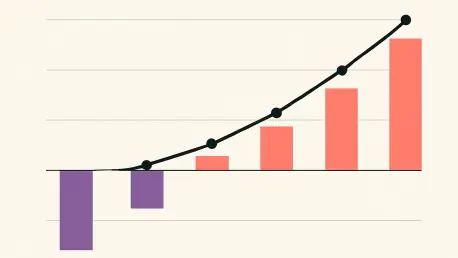

A monumental surge in borrowing across Saudi Arabia has propelled the kingdom's leading financial institutions to unprecedented heights, with two of the largest banks reporting record-breaking profits for the 2025 fiscal year. The recently released financial results for Saudi National Bank (SNB)

The financial industry is confronting a resurgent and insidious threat, one that bypasses complex code and sophisticated malware by weaponizing the oldest form of communication: the human voice. Voice-based scams have evolved from a consumer nuisance into a significant vulnerability for banks,

In a stunning display of market momentum that has captured the attention of the global financial community, precious metals have embarked on an extraordinary ascent, with gold decisively breaking through the monumental $5,000 per ounce barrier for the first time in history. This powerful surge on

In a move signaling a significant shift in the financial technology landscape, buy now, pay later (BNPL) giant Affirm Holdings has officially applied for a bank charter in Nevada. By seeking to establish Affirm Bank, a state-chartered industrial loan company (ILC), the company is aiming to break

Bay Commercial Bank (BCML) recently presented a complex financial picture to investors, as its fourth-quarter results showcased strong year-over-year expansion while simultaneously falling short of Wall Street’s carefully watched projections. The bank disclosed quarterly earnings of $0.63 per

A tectonic shift in global finance is channeling unprecedented levels of capital into the Middle East and Asia, creating a new generation of ultra-high-net-worth families and sophisticated family offices whose complex needs are fundamentally reshaping the wealth management industry. Nomura

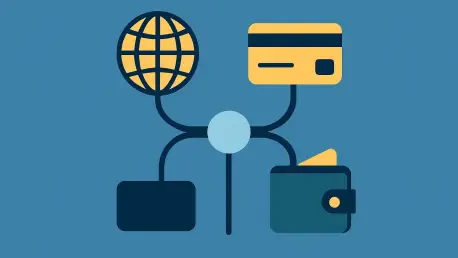

The simple act of sending money home to loved ones is undergoing a profound transformation, evolving from a basic transaction into a gateway for comprehensive financial inclusion for millions globally. In a move that underscores this industry-wide shift, UK-based remittance giant Zepz, the operator

The swift digital transformation of the financial sector is creating unprecedented opportunities in markets previously underserved by fintech innovation, and Albania is poised to witness a significant leap forward with the imminent launch of its first digital-only neobank. Jet Bank has embarked on

The Scottish National Investment Bank is facing a firestorm of public and political criticism after a year marked by staggering financial losses and controversial executive compensation. The year 2025 proved to be a pivotal moment for the taxpayer-funded institution, as long-standing concerns about

In a significant strategic realignment, the US business payments platform Checkbook has announced an immediate transition to a co-CEO leadership model, appointing company insiders Pia Thompson and Aditya Raikar to the top executive positions. The move signals a new chapter for the fintech firm,

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy