In a landmark development for Central Asia’s financial sector, Tuum, a pioneering provider of cloud-native core banking solutions, has joined forces with Bank CenterCredit (BCC), a leading financial institution in Kazakhstan, to unveil a cutting-edge Banking-as-a-Service (BaaS) platform. This

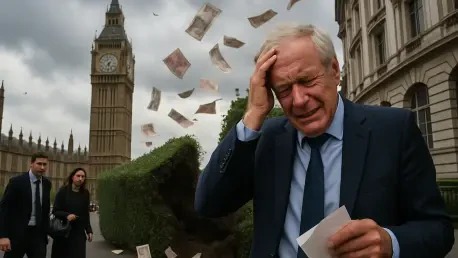

What happens when a rising star in London's financial scene crashes just four years after adopting an ambitious strategy? The sudden closure of Eisler Capital’s flagship multi-strategy fund sends shockwaves through the industry, exposing the brutal realities of competing in a market dominated by

What happens when the financial heartbeat of local economies begins to falter, and community banks, once the cornerstone of small-town America, start vanishing at an alarming rate? With a staggering 45% decline since their peak numbers, the crisis is not just a statistic—it’s a threat that could

In a groundbreaking development that is poised to reshape the financial advisory landscape, Creative Planning, recognized as one of the largest registered investment advisors (RIAs) in the United States, has entered into a definitive agreement to acquire SageView Advisory Group, a leading

As the U.S. government grapples with yet another shutdown, the financial stability of federal workers, servicemembers, and contractors hangs in the balance, with many unable to meet critical obligations like mortgage payments and credit card bills due to unpaid wages. This pressing issue has drawn

As the financial sector stands at a critical juncture in October 2025, the Federal Reserve’s (Fed) interest rate cuts have emerged as a transformative force, sending ripples across the S&P 500 Financials sector, which includes banks, insurance companies, and investment firms. These monetary policy

Imagine a financial boost just in time for the holiday season, where a simple switch of banking services could pad your account with hundreds of dollars, offering a unique chance to enhance your financial standing with minimal effort. Barclays Bank has rolled out an enticing promotion that promises

In an era where digital assets are increasingly shaping institutional investment strategies, platforms like Bullish (NYSE: BLSH) stand at the forefront of bridging traditional finance with blockchain innovation. Imagine a market where billions in cryptocurrency trades hinge on trust, transparency,

The defined contribution (DC) retirement plan arena is undergoing a profound transformation, positioning broker/dealers (B/Ds) at the forefront of an evolving industry landscape, where they must navigate significant changes and opportunities. Insights from a recent roundtable discussion among 23

In the intricate landscape of online gambling, Poland stands out as a market where stringent regulations intersect with the rapid adoption of modern technology, creating a unique environment for both operators and players who must navigate this complex terrain. The country’s legal framework,

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy