In the ever-evolving landscape of the packaging industry, strategic acquisitions often serve as pivotal moments that reshape market dynamics and redefine company trajectories, as seen in the recent transaction involving Color Craft Graphic Arts and PaperWorks Industries Inc. This deal, facilitated

In a transformative leap for the financial landscape of the United Arab Emirates, the introduction of the Digital Dirham marks a pivotal moment in the nation's journey toward a tech-driven economy, signaling a future where digital payments could redefine everyday transactions. This central bank

Dive into the dynamic world of digital currencies with Priya Jaiswal, a luminary in Banking, Business, and Finance, whose profound insights into market analysis and international business trends have shaped the fintech landscape. With a career dedicated to unraveling the complexities of portfolio

In an era where digital banking dominates and physical bank branches are vanishing at an alarming rate across the UK, Nationwide, a prominent financial institution, has taken a striking stand by pledging to keep its extensive network of 696 branches open until at least 2030. This commitment, which

In the fast-paced arena of global finance, markets are currently wrestling with an unprecedented wave of instability, driven by sharp declines in the tech sector and a barrage of conflicting economic indicators that challenge even the most seasoned investors. Imagine a landscape where a single

In a striking turn of events, Fayette County Public Schools (FCPS) in Lexington, Kentucky, finds itself under an intense spotlight due to significant financial challenges that have sparked public concern and multiple investigations, highlighting the urgent need for reform. The district, tasked with

In the rapidly evolving landscape of financial technology, stock market data APIs have emerged as indispensable tools shaping the future of the industry in 2025. These powerful interfaces provide seamless access to real-time, historical, and fundamental financial data, empowering developers,

In a striking move that underscores the intensifying competition within the payments technology sector, TPG, a leading US-based alternative asset manager, has tabled a binding offer of approximately €1 billion, equivalent to $1.16 billion, to acquire the digital banking solutions division of Nexi,

Welcome to an insightful conversation with Priya Jaiswal, a distinguished expert in banking, business, and finance. With her deep knowledge of market analysis, portfolio management, and international business trends, Priya offers a unique perspective on the evolving landscape of financial

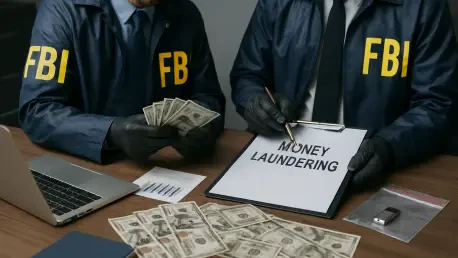

In a powerful strike against the Venezuelan regime, the FBI has unveiled a major operation that dismantled a sophisticated money laundering network intricately tied to the family of dictator Nicolás Maduro, exposing the financial underpinnings of a government long accused of corruption and criminal

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy