In a stunning turn of events that has gripped South Korea’s entertainment industry, a well-known actress has found herself at the center of a major financial scandal involving cryptocurrency, with the case adjudicated by the Jeju District Court. This high-profile conviction, which highlights

I'm thrilled to sit down with Priya Jaiswal, a distinguished expert in Banking, Business, and Finance, whose deep knowledge in market analysis, portfolio management, and international business trends has made her a trusted voice in the industry. Today, we’ll explore her insights on a financial

In a significant development for the banking sector, EagleBank, a prominent financial institution based in Bethesda, Maryland, with assets amounting to $10.8 billion, faces a pivotal moment as its long-standing CEO and Chair, Susan Riel, announces her retirement set for next year. This transition

What happens when a nation steeped in cash transactions takes a daring step into the digital age? In Guyana, where physical currency still dominates daily exchanges, a quiet revolution is unfolding, and on September 27, 2025, at its Georgetown corporate office, Demerara Bank Limited unveiled a

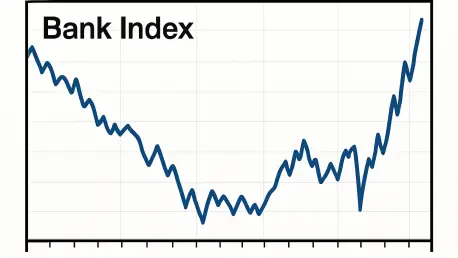

Western Alliance Bancorporation (NYSE: WAL), a key player in the regional banking landscape based in Las Vegas, has recently captured the spotlight among financial experts due to its promising market performance across Nevada, Arizona, and California. Known for delivering a mix of retail and

Imagine a scenario where countless individuals across the UK wake up on payday, expecting their hard-earned salaries to hit their accounts, only to find they can’t access a single penny due to a major banking outage. This frustrating reality struck customers of a prominent high street bank in the

In the heart of Osaka, a pivotal question looms over Japan's economic landscape: can the Bank of Japan (BOJ) push forward with an interest rate hike amid a storm of global uncertainties? Picture a nation on the cusp of breaking free from decades of deflation, only to face headwinds from faltering

Retirement planning has evolved far beyond simply saving for a comfortable future; it now demands a hard look at the escalating costs of aging, particularly in the realm of healthcare. With medical expenses climbing at a pace that outstrips general inflation, the necessity of preparing for

In the ever-evolving landscape of Canadian financial markets, the influence of major institutions like TD Bank (TSX:TD) cannot be overstated, particularly when their strategic moves or financial updates send ripples through key benchmarks such as the S&P/TSX Composite Index. As one of the largest

Imagine a scenario where a seemingly routine property transaction turns into a regulatory nightmare due to inadequate checks on the source of funds, exposing a conveyancing firm to severe penalties and reputational damage. This is not a far-fetched situation but a growing concern in the legal

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy